Believe it or not, there are better ways to save than refraining from side orders at dinner.

Women have long been advocating for equal pay for equal work, but for the LGBTQ community job security is just as significant an issue as equitable pay. Today, 17 states lack workplace discrimination laws that protect private or public employees from being fired for their sexual orientation or gender identity and if suddenly unemployed 56 percent of Americans lack emergency funds to cover expenses for three months1.

While passage of the Equality Act remains uncertain, members of the LGBTQ community can improve their own financial future and develop financial confidence by taking steps to improve their financial security.

According to The Guardian Study of Financial and Emotional ConfidenceTM, 78 percent of working American families are stressed about their financial future regardless of age, gender, income or other demographics. However, their behaviors contradict the financial priorities they identify as most important to their lives:

- While 52 percent of Americans say that building savings is a priority, more than two-thirds would not describe themselves as good at living within their means;

- Having a solid, long-term plan for achieving financial objectives is a top priority for 47 percent of Americans; however, 81 percent don’t feel that they’re good at setting up a long-term financial plan and sticking with it;

- Nearly 60 percent of Americans believe that having at least some guaranteed income apart from Social Security in retirement is a priority, but less than one in four feel confident in any aspect of their retirement finances.

How do these findings correlate with the financial priorities of members of the LGBTQ community?

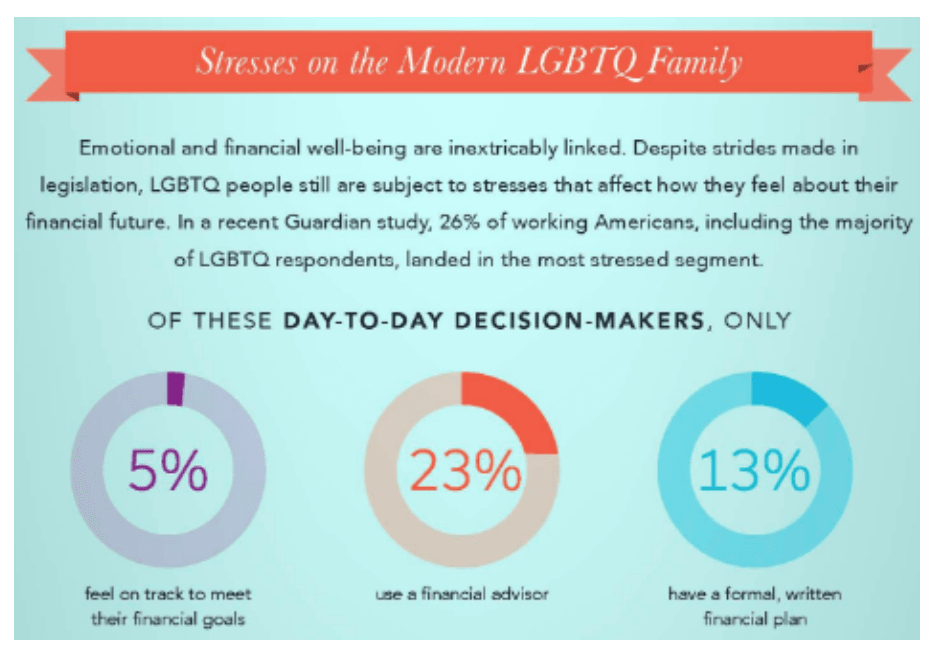

In comparison, 26 percent of working Americans and the majority of LGBTQ respondents landed in the most stressed and struggling segment when it came to financial confidence. This segment is classified as “Day-to-Day Decision-Makers” in their approach to handling their finances and also included the highest proportion of women and millennials.

The study found that “Day-to-Day Decision-Makers” may have trouble living within their means, aren’t receptive to advice, and don’t have realistic and achievable financial expectations. They struggle with keeping up with monthly expenses and lack focus on their long-term financial goals, such as retirement or buying a home. Since Day-to-Day Decision-Makers put a significant emphasis on keeping up with monthly expenses there’s a below average emphasis on financial planning. Based on their current struggles, individuals in this segment lack an inspiring vision and are less likely to be satisfied with life and feel confident.

There are many stress producers in our lives that we can’t control, such as discrimination, reactions to politics, and the pace of change. We can, however, take control of how we approach our finances to reduce our overall stress by being proactive and prioritizing our finances:

Make a Plan – Financial confidence begins with a plan. It doesn’t need to be elaborate, but it shouldn’t be short-sighted. Financially confident individuals are much more focused on the long-term than the short-term and live within set means. Having a plan in place can reduce stress and increase happiness, so write down your short- and long-term financial priorities and what you think you’ll need to achieve them. Check the list once a year, gauge your progress and make adjustments as needed.

Knowledge Is Power – You’re far more likely to succeed if you understand fundamental financial concepts and products, such as investments, insurance, and annuities. Financially confident people understand the concepts of budgeting, risk tolerance, and asset allocation and the financial solutions that can help to get them there. To expand your financial knowledge utilize free courses online or ask your HR department if there’s resources you can utilize.

Own the Solutions – Confident planners own a spectrum of products (mutual funds, stocks, bonds, retirement plans, and insurance) that they know will help them achieve their financial and life priorities – with no significant gaps. Document what you own and why you own it, then look to your plan to determine where you might have gaps.

Find a Trusted Professional – Having a reliable, go-to resource is a major factor in having financial confidence. The financially confident are more likely to have a strategic relationship with an advisor that they trust as their financial coach, offer strategies to generate retirement income, and help them create a holistic financial plan.

You may never win the lottery, but you can win the money battle. By incorporating a few changes now, you can improve your financial confidence and reduce one of your main sources of stress. It may not happen overnight, but it can happen. Education and adoption of good financial practices can help anyone go from financially stressed to confident. To assess and learn more about your financial situation take this quiz.

[1] Human Rights Campaign April 25, 2017.

[2] FINRA’s National Financial Capability Study here.

About the author: Cynthia L. Hearing is Senior Consultant at The Guardian Life Insurance Company of America.